46

| WORLD FERTILIZER |

NOVEMBER 2016

cash costs due to its geology. Picadilly was expected to

ramp up to a capacity of 1.1 million t in 2015, with the

nearby Penobsquis mine to run in tandem during the

Picadilly ramp-up. However, decommissioning at

Penobsquis was bought forward to the end of November

2016.

PCS President and CEO, Jochen Tilk, said, in an investor

conference in Canada in January, that in 2007 when

investment began at the Picadilly mine, expectations for

annual potash demand in 2015 were around 70 million t,

however demand last year came in at 59 million t.

“In a commodity business in a difficult time, you

consolidate, you rationalise and you optimise,” Tilk said in

July.

At the investor conference, Tilk said production

would be focused on PCS' lowest costs mines where cash

costs are around US$40/t. However, he was unwilling to

divulge the costs of Picadilly.

Mosaic followed suit in announcing cutbacks, with its

2.6 million t capacity Colonsay mine idled in July.

Mosaic said its lower-cost mines of Esterhazy and

Belle Plaine, in combination with inventory, would allow it

to meet the short-term supply needs.

The shuttering of the Colonsay mine followed lower

production from Uralkali in Russia, with its Q2 production

at 2.5 million t, down from 3 million t in 2Q15. Its H1

production was at 5.1 million t, compared with 1H15 at

5.7 million t. BPC also reduced production to around 70%

of capacity.

Meanwhile, Agrium had been busy increasing its

capacity, with it completing the Canpotex proving run for

the 1 million t production expansion at its Vanscoy potash

facility in Saskatchewan in December 2015.

The enhanced facility now has an annual nameplate

capacity of 3.024 million t and the producer said it

expects its Canpotex allotment to be approximately 10.5%

of the organisation’s total international shipments in 2016.

Canpotex said in February it would reduce

January – June export volumes by at least 1.5 million t and

also flagged the possibility of further reductions to sales

volumes in 2H16.

Canpotex decided in June not to proceed with the

construction of a new export terminal at the Port of

Prince Rupert in British Columbia, and is instead set to

rely on its terminals in Vancouver, Saint John and Portland,

Oregon. The facility was expected to cost CAN$775

million (US$602 million) and was initially expected to be

operational in 2012.

US-based Intrepid Potash idled operations at its

New Mexico-based West facility and transitioned the

facility to care-and-maintenance mode in July. The West

mine generated 42% of Intrepid’s potash production in

2015 and has a capacity of around 380 000 tpy.

Germany’s K+S did not make any cutbacks due to

prices, however, the producer struggled to operate at full

capacity at a number of its sites due to saline wastewater

disposal issues.

K+S said in July its Unterbreizbach site had resumed

operation, but continuing operations were not

guaranteed. At its Werra site, production is also being

affected by saline wastewater issues and available basin

capacities. At the Hattorf site, production remains

suspended since June, due to similar issues. Only K+S’

Wintershall site has not been affected by production

shut-downs.

Outlook

With delays to the start of production at K+S’s Legacy

mine, sentiment was further bolstered in August when

BHP Billiton signalled it may shelve its Canada-based

Jansen project if the outlook for potash does not

improve. It said while the two shafts will be completed

sometime in 2018 or 2019, the board will then decide

whether to build the mine, despite US$2.6 billion spent in

development.

BHP has previously said it was open to having a

partner on the project, but shareholder sentiment is

tending towards moth-balling the mine.

In mid-August, Jansen was at 60% completion. The

project was at 54% complete at the end of 2015. Its

current investment is to finish the excavation and lining of

the production and service shafts and to continue the

installation of essential surface infrastructure and utilities.

However, capacity increases and a more aggressive

strategy was emerging from the CIS region, with Uralkali

moving towards a delisting from the Moscow Stock

Exchange and new capacity from EuroChem expected in

2017, while BPC continued to build its new mines.

In early September, Uralkali reduced its free float

shares on the Moscow exchange via its buyback

programme to about 6.5% of the company’s capital. Under

the exchange listing rules, if a free float remains below

7.5% for six consecutive months the share will be

excluded from the level 1 ‘blue chip’ quotation list.

The expected delisting on the Moscow Exchange

could be a prelude to a merger with Uralchem, which

already owns 20% of Uralkali’s shares.

Despite the possibility of a tie-up of the Russian

majors of Uralkali and Uralchem, moves are still afoot to

return Uralkali and BPC to a partnership. Other Uralkali

major shareholder Onexim sold its 20% stake to

Belarusian businessman Dmitri Lobyak in July. The sale

came shortly after Belarus’ president Alexander

Lukashenko suggested agreement between Belaruskali and

Uralkali could happen again.

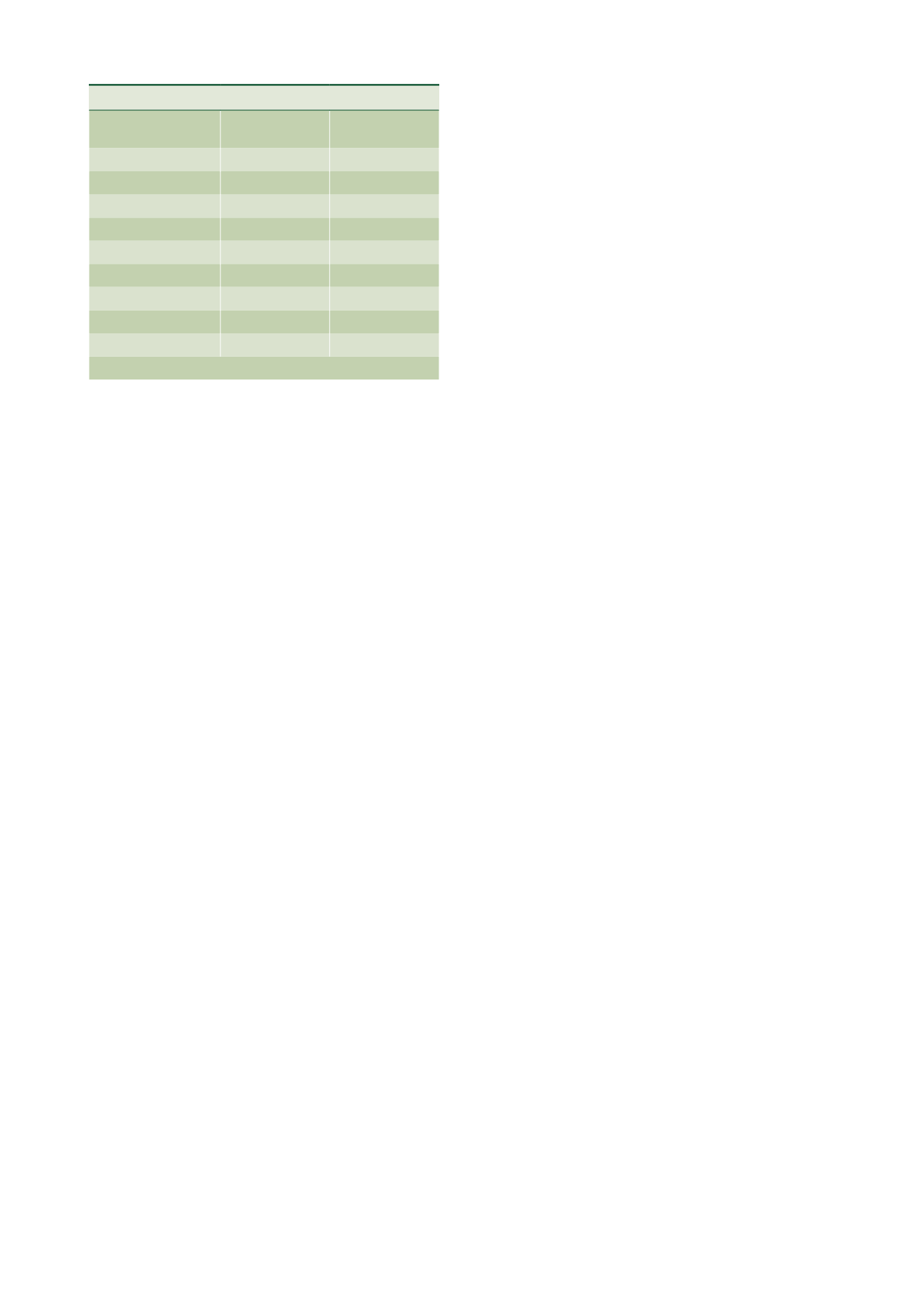

Table 1.

Producer sales volumes

Sales volumes (KCI

tonnes)

1H16

1H15

Uralkali

4.9 million

5.6 million

PotashCorp

3.905 million

4.861 million

BPC*

3.8 million

4.6 million

Mosaic

3.586 million

4.369 million

K+S

3.17 million

3.55 million

ICL

2.041 million

1.86 million

Agrium

1.153 million

694 000

APC

782 000

1.093 million

Total

18.437 million 21.027 million

Source: company reports, *K20 to KCI export tonnes.