44

| WORLD FERTILIZER |

NOVEMBER 2016

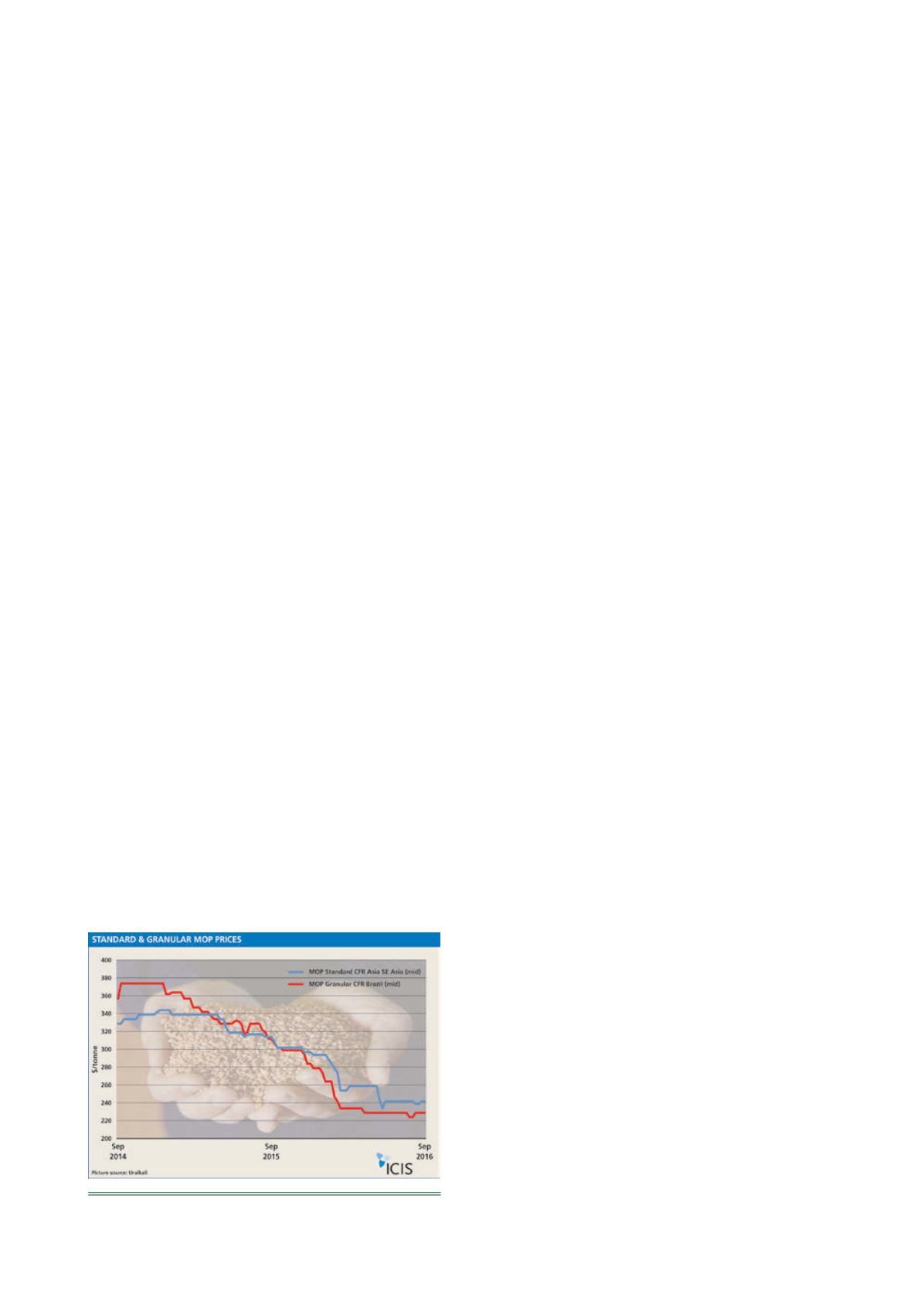

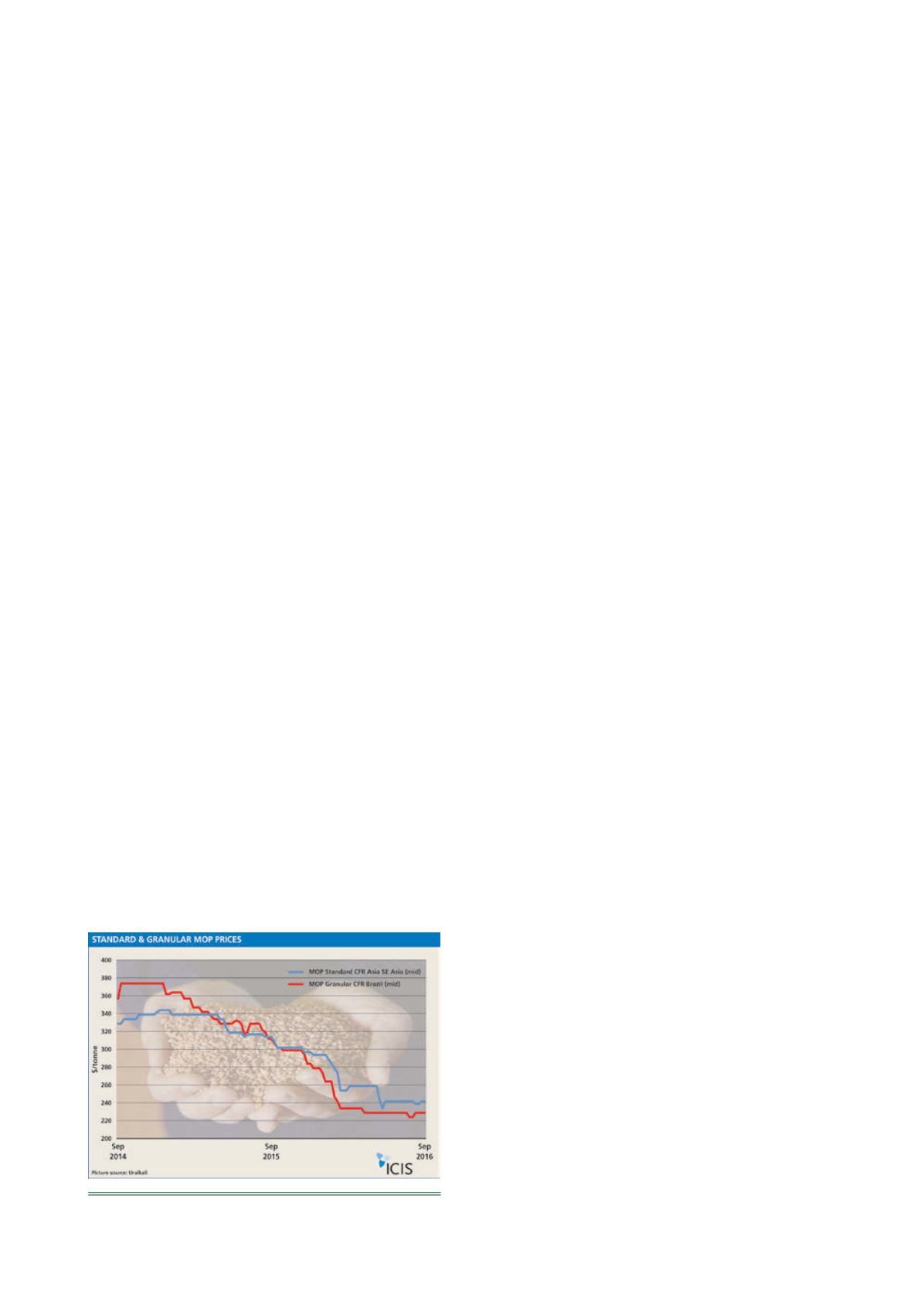

tonnes in alternative markets. As such, spot buying

regions, such as Brazil, Malaysia and Indonesia, drove

down the price of both granular and standard grade

potash.

The US, Brazil and Europe were targeted to take up

the slack when Chinese and Indian contract deliveries

halted as delays to new contracts stalled.

While European prices held up remarkably well, the US

became the most cheaply priced market in the world as

North American producers struggled to place tonnes and

inventories as warehouses grew. US import demand during

the first half of the year fell well below 2015 levels, with

the first uptick in year-on-year imports coming only in July.

Brazilian demand was a high-point in the market, with

a rise in imports of granular product, despite the country

struggling against a depreciating currency, credit issues

and wider political instability.

Finally in June, following months of uncertainty over

Chinese contract settlements, Indian buyers wary of the

upcoming kharif season moved first, securing contract

deliveries from 1 July 2016 until March 2017 at US$227/t

CFR (cost & freight). Lead negotiator Indian Potash Ltd

(IPL) struck the deal with the Belarusian Potash Co. (BPC).

IPL and BPC signed a five year supply deal from

2016 – 2020, announced in January 2016, but with no

volumes or prices.

Despite calls for greater producer discipline, the

Indian negotiations showed divergence, with Canpotex,

the North American export arm of PotashCorp (PCS),

Agrium and Mosaic, unwilling to officially announce its

commitments to India. The legal cartel was understood to

be reluctant to accept the price of US$227/t CFR and

would only agree deliveries for 3 – 6 months, with it

expected to attempt to renegotiate prices at the end of

that period.

Total tonnes agreed to Indian buyers so far according

to ICIS data is around 3.3 million t. However, as above,

Canpotex is understood to have only committed tonnes

until December, while Uralkali will deliver tonnes until

July 2017.

During the last contract period with India, (officially

April 2015 – March 2016, but including June with carryover

tonnes), BPC delivered 1.3 million t, Uralkali 1 million t and

Canpotex 0.9 million t, with the total imports at

4.4 million t, according to ICIS data.

Following the settlement of Indian contracts, BPC was

again first to reach an agreement with the Chinese buying

consortium of Sinochem Fertilizer Macao Commercial

Offshore Ltd (Sinofert), China National Agriculture Means

of Production Group (CNAMPGC) and China National

Offshore Oil Corp. (CNOOC) at US$219/t CFR China. BPC

and CNAAMPGC have a memorandum of cooperation

from 2016 – 2020.

At the time of settlement in mid-July, BPC Director

General Elena Kudryavets said: “The deal with China

logically arises from the contract with India being

previously entered into, and we are confident that the

Chinese deal will contribute to stabilising the global

potash market and secure its upward advance.”

“This price level reflects the actual market situation

and the trends prevailing in the global potash market,”

Kudryavets added.

BPC is expected to ship around 1.3 million t to China

by the end of 2016, under the new contract deal.

As with Indian contracts, Canpotex has not disclosed

its commitments to China for the current period. Its 2015

shipments were expected to be at least 1.8 million t.

Canpotex has a MoU with Sinofert from January 2015 to

December 2017, with a minimum of 1.9 million t of

standard red MOP to be delivered across the period, and

2.4 million t optional of other grades with prices to be

negotiated every six months.

Israel Chemical Co. (ICL) will supply around 700 000 t

to China for the remainder of 2016. ICL announced in

January it had agreed to supply 1.1 million t in 2016, as part

of a deal spanning from 2016 – 2018. Volumes in 2017 are

1.14 million and 1.16 million in 2018.

Uralkali concluded Chinese supply contracts for

600 000 t for delivery from August 2016 – January 2017.

Arab Potash Co. (APC) and Sinofert had agreed for

600 000 tpy from 2014 – 2016, with Sinofert the exclusive

channel for all APC sales. No new deal has been

announced yet.

Supply

Following the settlement of contracts and the resumption

of deliveries of major tonnes, the market received a boost

in news of delays to the start-up of the K+S Legacy mine

in Canada from the expected start-up in late 2016 to the

second quarter of 2017.

In July, a process vessel became detached from its

mounting during a routine test and fell to the floor

causing considerable damage. While commissioning on

Legacy went ahead in August, production will be below

the expected volume of up to 1 million t in the course of

the delayed start-up period next year. Despite this, K+S is

still assuming it will be able to reach its target production

capacity of 2 million t at the end of 2017.

The delays to K+S certainly lifted sentiment, following

months of curtailments and idling of production at PCS

and Mosaic’s Canadian mines.

PCS, the largest of the North American producers,

announced in January the indefinite suspension of its

operations at Picadilly in New Brunswick, Canada.

The Picadilly mine is the newest PCS mine, costing

CAN$2.2 billion, but it had the most expensive per tonne

Figure 1.

Potash prices have begun to stabilise.