NOVEMBER 2016

| WORLD FERTILIZER |

19

n

n

Firstly, China is the only large producer of

nitrogen fertilizers that primarily uses coal –

instead of natural gas – as the raw material for

ammonia production, with ammonia being the

main component of most nitrogen fertilizers. This

is owing to the fact that Chinese coal is

significantly cheaper and more abundantly

available to domestic nitrogen producers than

natural gas; this is a situation that is in stark

contrast to producers in the US, Russia and the

Middle East and North Africa (MENA) region.

n

n

Secondly, despite the use of coal instead of

natural gas, Chinese nitrogen producers still face

some of the highest costs in the industry, as other

global producers have direct access to natural gas

that is cheaper than Chinese coal. This means that

they face lower input costs than their Chinese

peers. In a global comparison, the cost of Chinese

coal-based nitrogen production is above that of

most regions, including Western Europe, where

producers rely on relatively expensive natural gas.

Despite high operating costs, China continues to

be the world’s largest exporter of nitrogen fertilizers,

consistently producing large surpluses of nitrogen

products – urea in particular. The combination of

large surpluses and elevated production costs have

resulted in China becoming a swing producer on the

global market. Indeed, the country is able to channel

substantial amounts of fertilizers to the export

market at little extra cost if global prices become

more attractive than domestic prices. Conversely, as

prices fall close to or below Chinese production

costs, the country is able to withdraw large quantities

of the product from the market.

In spite of emerging challenges to the Chinese nitrogen

sector over the next five years, BMI does not expect these

to materially affect its positive outlook on the sector out

to 2020.

Chinese coal sector: consolidation will

not affect nitrogen producers

The biggest challenge facing China will come from a

reduction in its coal production; BMI’s mining team

forecasts a sharp decline over the coming two years. That

said, the group does not expect this to be a major

impediment to the nitrogen industry, as the Chinese

government is pushing for coal consolidation in order to

curb overcapacity, meaning there is still enough cheap

coal available for domestic industries. Coal production

will decline from a high base, and any strength in demand

will not be sufficient to push prices significantly higher.

Therefore, BMI expects the impact to be minimal for

Chinese nitrogen producers over the coming quarters.

Towards the later years of BMI’s 2016 – 2020 forecast

period, challenges from the coal sector will fade.

Production growth is expected to recover by 2018, while

consumption will remain on its secular decline. In

particular, Chinese power generation, which made up

half of the country’s coal consumption in 2013, will

steadily reduce its reliance on coal over the coming

years. Consequently, Chinese nitrogen producers will

continue to benefit from abundant coal supply and

relatively low coal prices out to 2020.

Weaker fertilizer consumption: no major

risk out to 2020

Subdued agricultural production growth and a potential

contraction in fertilizer consumption constitute further

challenges to the country’s nitrogen sector. The group

sees two factors driving weaker fertilizer consumption in

China over the next five years: slower growth in

agricultural production and rising environmental

concerns.

Regarding agricultural production, the agricultural

sector is the prime consumer of nitrogen products and

the Chinese nitrogen sector is heavily dependent on the

domestic market despite the country being the world’s

largest exporter. In 2013, crops absorbed 93% of the

country’s total nitrogen production. BMI forecasts

growth in Chinese crop production to be slower over

the 2016 – 2020 period than during the previous five

years. Nevertheless, this slower growth will occur from

a high base, much like coal production, and will remain

positive for most crops. Consequently, the group

expects demand from the agricultural sector to remain

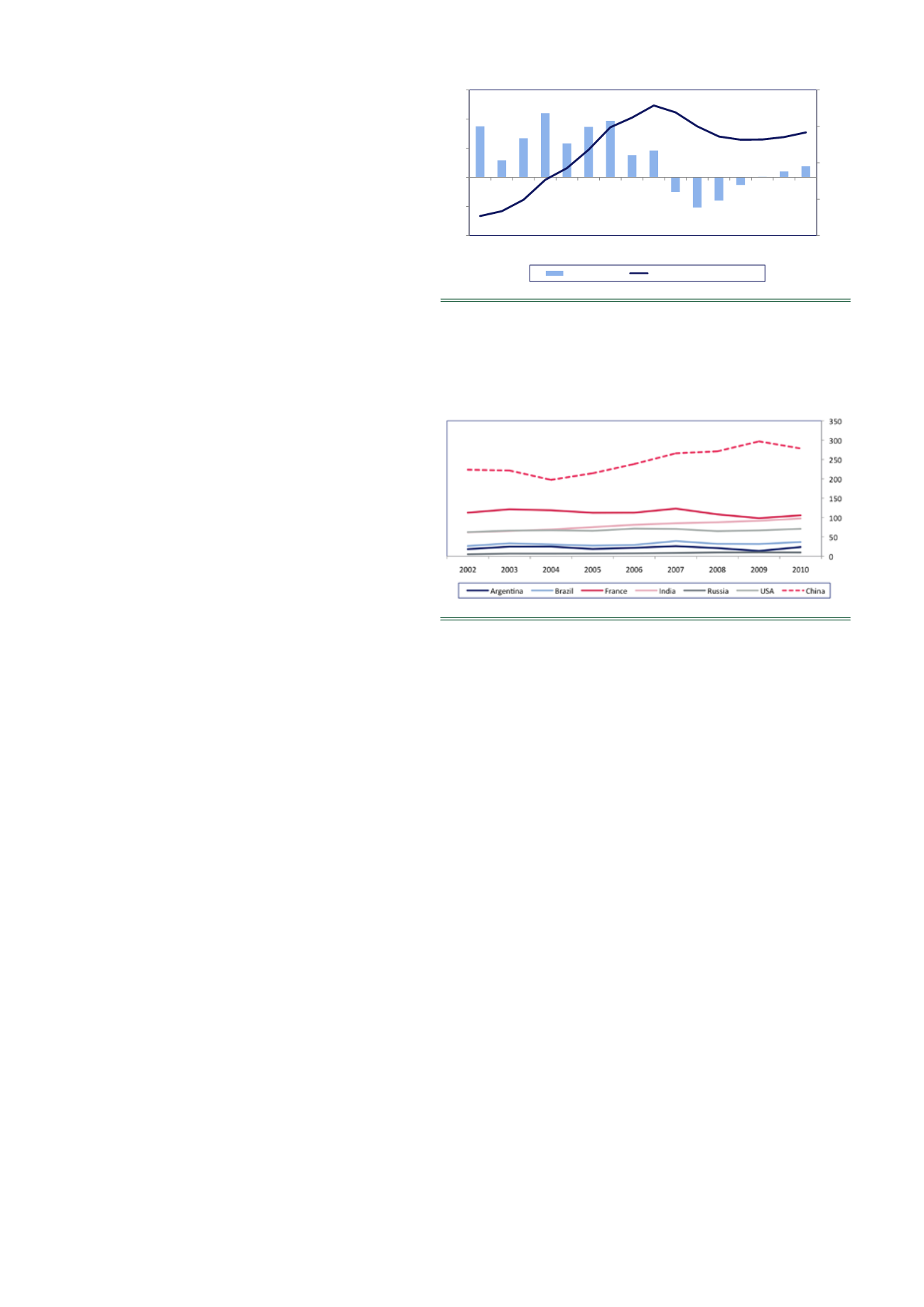

Figure 7.

China's overuse of nitrogen to continue out to 2020.

Select countries – nitrogen fertilizer consumption (tonnes of

nutrients per '000 ha.).

Source: FAO, BMI.

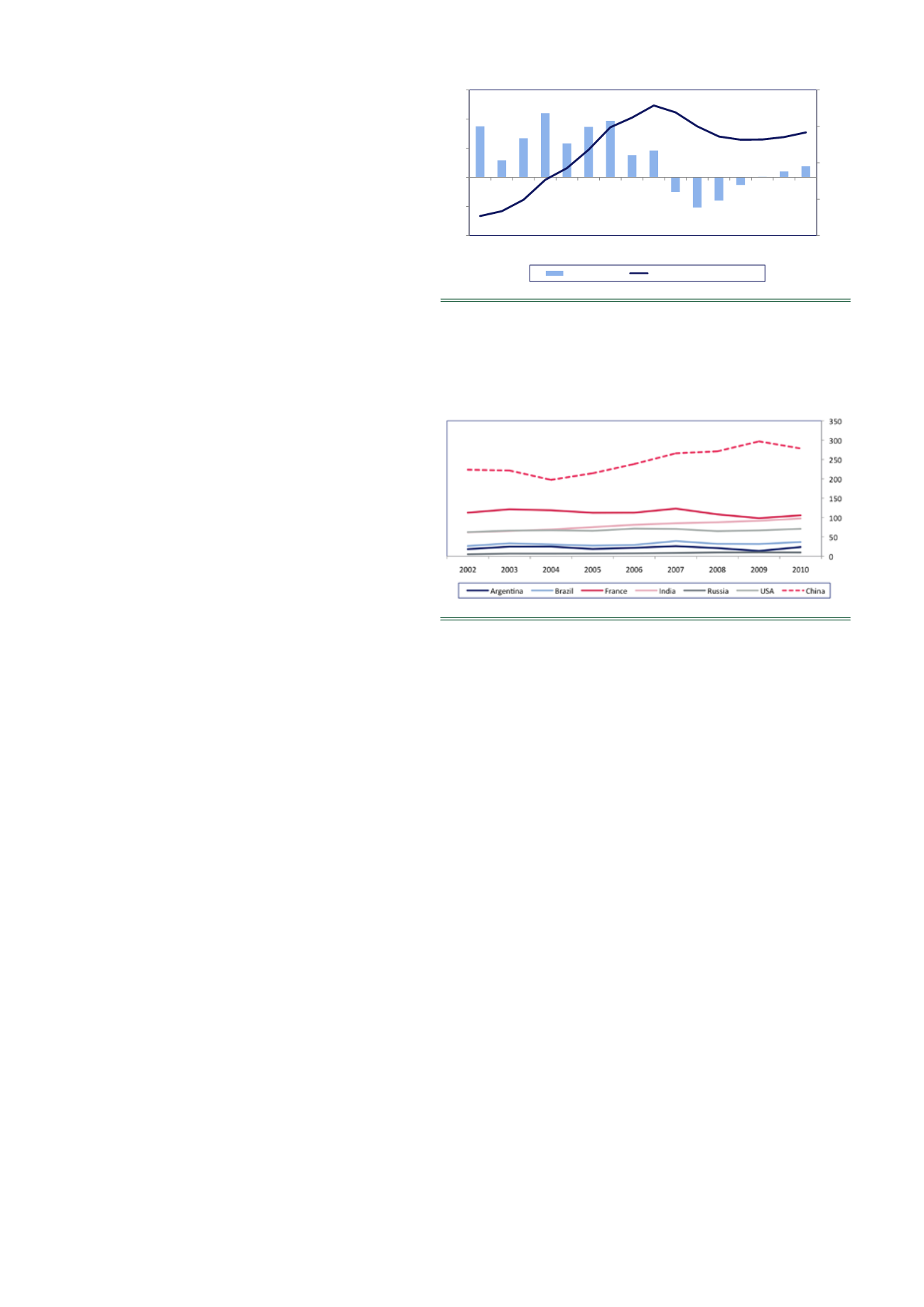

Figure 6.

Contracting coal output: no threat to nitrogen sector.

China – coal mine production (million tonnes) and growth

(% year-on-year).

Source: e/f = BMI forecast. Energy Information Administration,

BMI.

SeqId Geography

Service Name

1 China

Mining

Coal Mine Produc2on (R

2 China

Mining

Growth (LHS)

2,000

2,500

3,000

3,500

4,000

-10

-5

0

5

10

15

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016f2017f2018f2019f2020f

Growth (LHS)

Coal Mine Produc2on (RHS)