18

| WORLD FERTILIZER |

NOVEMBER 2016

This outperformance of urea in emerging markets is

due to the following reasons. First, urea is generally

cheaper than other nitrogen fertilizers on a per nutrient

basis as it contains 46% nitrogen, second only behind

ammonia itself. Second, urea is easier to distribute and

apply than anhydrous ammonia. This is because urea

comes in dry solid form, prilled or granular, while

ammonia comes as a pressured liquid that is flammable

and turns into gas when applied. Third, urea is relatively

easy to blend with other types of fertilizers for

application and it dissolves well in water.

Regarding crops, given that nitrogen is a key nutrient

required by most plants for growth, grains and oilseeds

hold the largest share of the world’s nitrogen

consumption as they are the most cultivated crops at the

global level. The notable exception is soybean. While

soybean has similar phosphate and potash requirements

as grains and other oilseeds, the crop requires very little

nitrogen. This is because soybean has a nitrogen-fixing

ability, as it is able to get its nitrogen requirements

through a symbiotic relationship with soil bacteria, a trait

similar to legumes but unlike grains and other oilseeds.

Additionally, the research group highlight a side-trend in

nitrogen consumption: the growth differential between

industrial and fertilizer use of nitrogen. Industrial use

accounts for about 20% of total nitrogen consumption

according to estimates by Yara, and the IFA forecasts this

segment to grow by almost 30% between 2014 and 2019. In

contrast, fertilizer, the main user of nitrogen, will only grow

by about 6% over the same period. Examples of industrial

use of nitrogen include speciality chemicals, explosives and

emission filters. BMI Research will monitor the evolution of

this trend in the coming years and determine whether it

represents a risk for the nitrogen fertilizer market.

Focus on the Chinese nitrogen industry:

remaining a world leader despite

challenges

China is the world’s largest producer of nitrogen

fertilizers, and this position will be secured by further

investment into production capacity. Over BMI’s forecast

period to 2020, the country is set to increase ammonia

production capacity and build new urea production units

– despite already being the world leader in this regard.

However, the group highlights that China’s dominance

over the global nitrogen market is paradoxical for two

reasons:

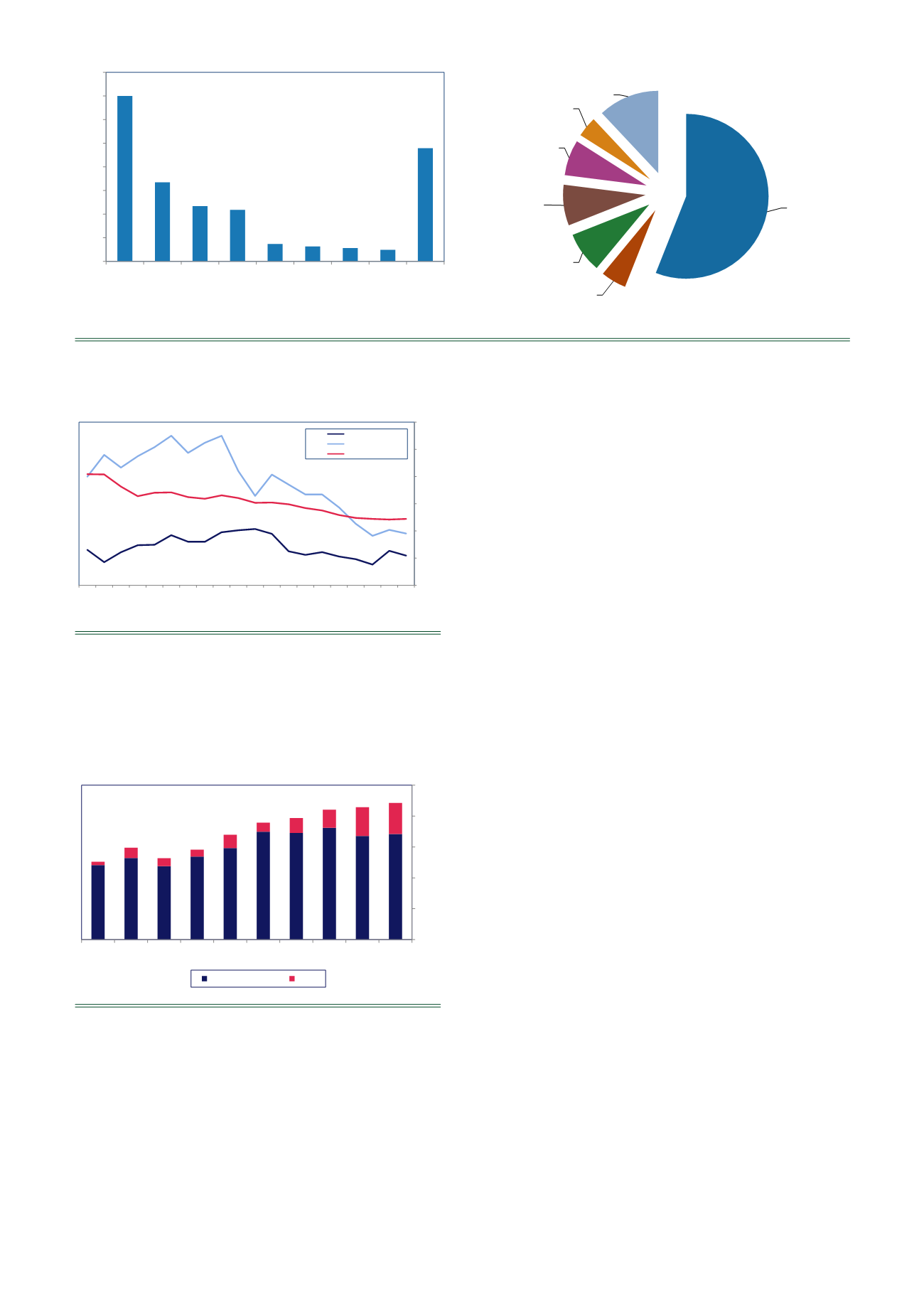

Figure 3.

Emerging countries favouring urea drives global nitrogen market. LHC: 2013 nitrogen fertilizer consumption (million

nutrient tonnes); RHC: global nitrogen consumption, 2011 product breakdown (%).

Source: IFA.

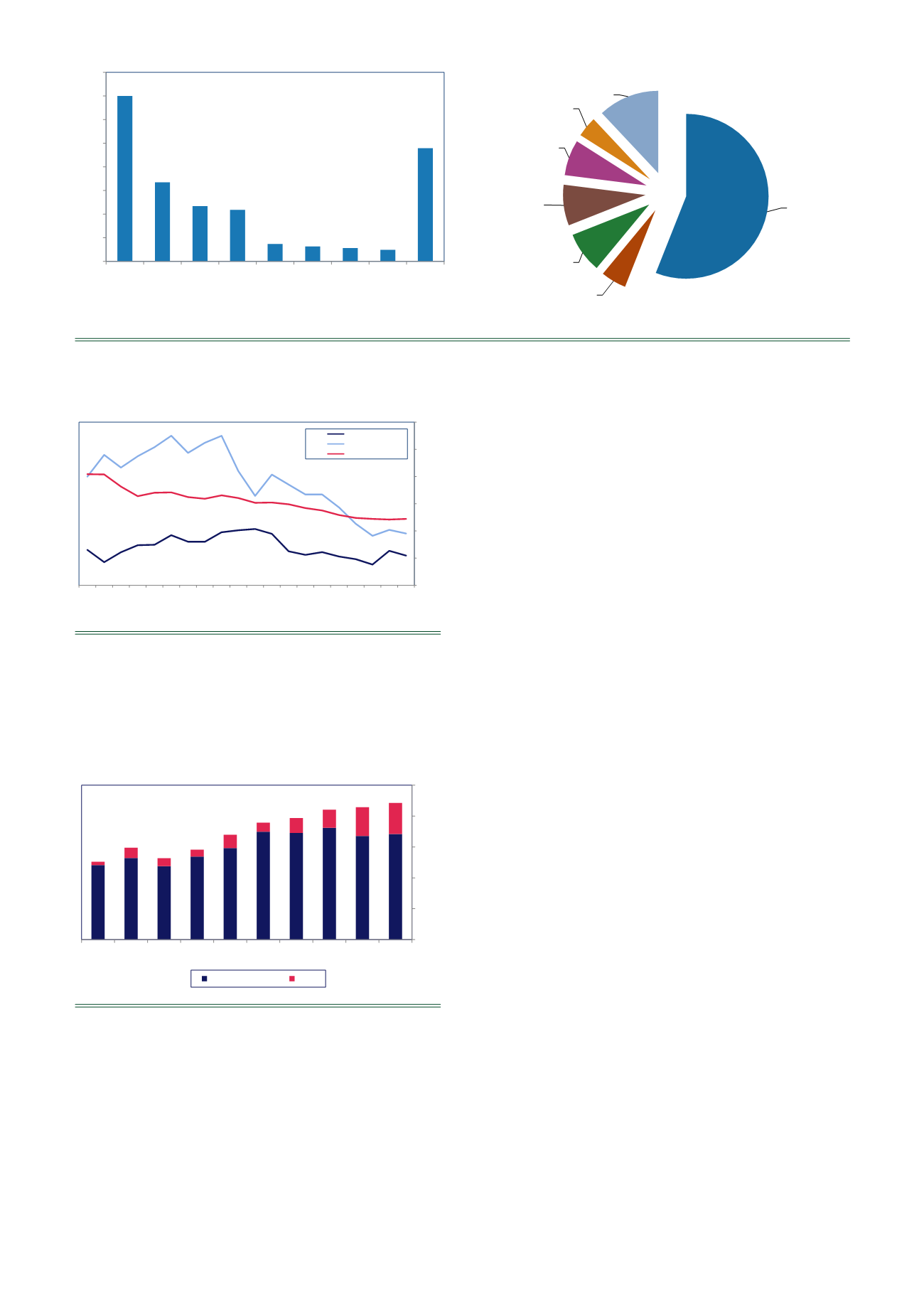

Figure 4.

China produces nitrogen at the highest cost.

Select regions – total cost of production for integrated

urea manufacturing (US$/t).

Note: 'Integrated urea' refers to a manufacturing plant that

produces urea using ammonia that is also produced on site

.

Source: Bloomberg, BMI.

Figure 5.

China: swing producer on the nitrogen export

market. Nitrogen fertilizers – total exports by origin

(million tonnes).

Source: ITC, BMI.

0

5

10

15

20

25

30

35

40

China

India

USA

EU

Brazil

Pakistan

Indonesia

Canada

Other

Urea

56%

UAN

5%

AN/CAN

8%

NPK

8%

DAP/MAP

7%

Ammonia

4%

Other

12%

Q316

Q216

Q116

Q415

Q315

Q215

Q115

Q414

North America104.72514 113.50751 88.284342 98.164506 103.05231 111.10282 106.08432 112.59268

Europe 145.39352 152.04381 141.10767 163.25022 193.40929 217.06758 217.09633 235.32445

China

172.21204 171.06652 172.22137 174.00836 179.3793 187.69864 192.15512 199.13295

North AmericaEurope China

Q411

115.20648 250.10418 254.52956

Q112

92.649388 289.95339 254.01956

Q212

110.89371 266.62183 231.66868

Q312

123.85816 287.44885 213.98944

Q412

124.66844 304.11156 220.3772

Q113

142.25931 325.11083 220.99501

Q213

130.26197 293.67936 212.32975

Q313

130.13128 312.23577 209.27448

Q413

147.64374 325.0264 215.5898

Q114

151.3292 260.09804 210.57723

Q214

153.68162 214.58264 201.83773

Q314

144.7947 253.70939 202.34271

Q414

112.59268 235.32445 199.13295

Q115

106.08432 217.09633 192.15512

Q215

111.10282 217.06758 187.69864

Q315

103.05231 193.40929 179.3793

Q415

98.164506 163.25022 174.00836

Q116

88.284342 141.10767 172.22137

Q216

113.50751 152.04381 171.06652

Q316

104.72514 145.39352 172.21204

50

100

150

200

250

300

350

Q411

Q112

Q212

Q312

Q412

Q113

Q213

Q313

Q413

Q114

Q214

Q314

Q414

Q115

Q215

Q315

Q415

Q116

Q216

Q316

NorthAmerica

Europe

China

Exporters

2006

2007

2008

2009

2010

2011

World

50,488,032 59,533,801 52,759,931 58,307,635 67,924,462 75,729,640

China

2,209,332 6,633,330 5,257,110 4,484,919 8,578,932 5,865,108

exported quan?ty of nitrogen fer?lisers

tonnes

2006

2007

2008

2009

2010

2011

Rest Of The World 48

53

48

54

59

70

China

2

7

5

4

9

6

0

20

40

60

80

100

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Rest Of The World China